SHIR ELAZARI

Life Plan

Mobile and Desktop | Web Service

My role: Research and UX Design.

Today's reality has changed the rules and created the need for proper financial planning for every household seeking to manage its financial assets effectively and achieve economic well-being. First International Bank of Israel (FIBI) has developed a financial planning system that calculates the user's liabilities and assets, while also outlining investment strategies. This system not only highlights the challenges and difficulties in achieving their goals but also presents the bank's solutions for reaching those objectives during the planning process. The system is currently live and available exclusively to FIBI’s customers, with plans to expand to clients of all banks in the future.

Purpose of the Initiative

Improve the onboarding process for the Life Plan system. Encourage users to log in and share information, and provide users with real value that will enable them to engage with the brand.

״What is this thing?״

Long and Tedious Questionnaire.

"Why are they asking me this?"

Lack of Trust in the Product.

Product Goals: User vs. Business.

Users

Added Personal Value for the Customer

Providing a Comprehensive Financial Overview in One Place

Enhanced Service Experience for Bank Customers

Business

Increased Sales and Bank Products

Transferring Customer Funds from External Sources to the Bank

Attracting New Customers to the Bank

Target Audiences

Young Adults

At the Beginning of Their Journey to Financial Independence

Older Adults

Preparing for Retirement and Pension

Current Issues

Unclear Onboarding.

Unclear Terminology and Language.

Lack of Build-Up or Engagement with the Customer for the Product.

After Login - Unclear and Inconsistent CTA.

The onboarding process should set clear expectations and explain the tool effectively, providing value as early as possible rather than only at the end. Transparency is essential. Relevant information should be delivered at the right moment, avoiding overwhelming users with everything at once. In order to create commitment, questions should progress from easy to difficult. Initially, we should focus on the necessary steps to onboard users to the system, ensuring a smooth first impression and a good user experience. After gaining the user's trust, we can ask for more personal and sensitive data.

Concept - Guiding Principles:

Creating a user-friendly and engaging process

Short questions, accessible language and young Design.

Creating a personalized process based on the user’s needs

Guiding the user according to their goals: Preparing for Retirement or Setting a Specific Savings Target.

Getting a foot in the door, then building commitment

Bringing the user into the system in the shortest process possible.

User freedom of choice

Giving the user a sense that they are choosing to share information with us, rather than feeling interrogated.

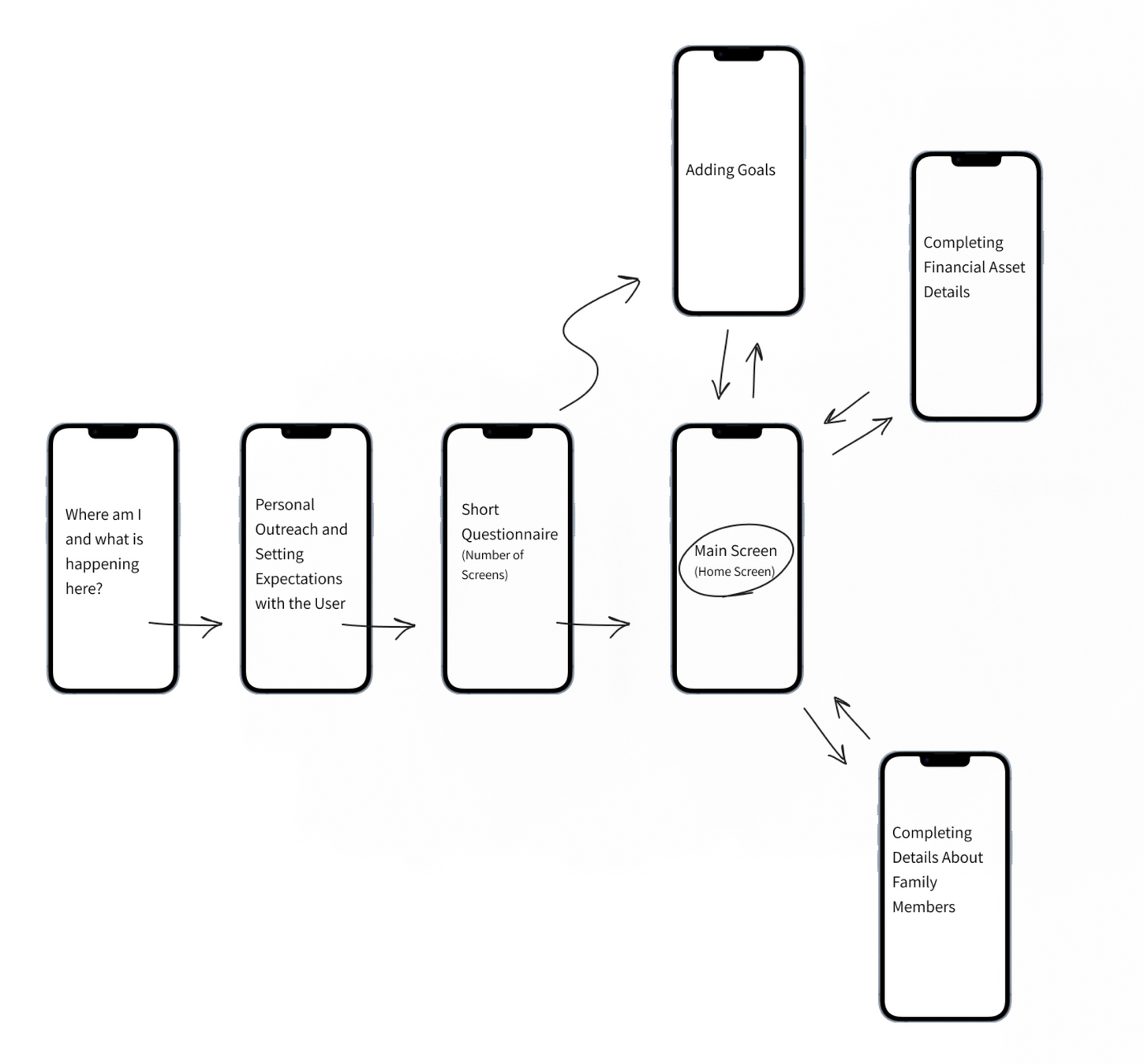

Principal Journey

Screens

״What is this thing?״

"Why are they asking me this?"

Long and Tedious Questionnaire.

Lack of Trust in the Product.

Purpose of the Initiative

Improve the onboarding process for the Life Plan system. Encourage users to log in and share information, and provide users with real value that will enable them to engage with the brand.

Added Personal Value for the Customer

Providing a Comprehensive Financial Overview in One Place

Enhanced Service Experience for Bank Customers

Increased Sales and Bank Products

Transferring Customer Funds from External Sources to the Bank

Attracting New Customers to the Bank

Product Goals: User vs. Business.

Users

Business

Young Adults

At the Beginning of Their Journey to Financial Independence

Older Adults

Preparing for Retirement and Pension

Target Audiences

Unclear Onboarding.

Unclear Terminology and Language.

Lack of Build-Up or Engagement with the Customer for the Product.

After Login - Unclear and Inconsistent CTA.

Current Issues

The onboarding process should set clear expectations and explain the tool effectively, providing value as early as possible rather than only at the end. Transparency is essential. Relevant information should be delivered at the right moment, avoiding overwhelming users with everything at once. In order to create commitment, questions should progress from easy to difficult. Initially, we should focus on the necessary steps to onboard users to the system, ensuring a smooth first impression and a good user experience. After gaining the user's trust, we can ask for more personal and sensitive data.

Creating a user-friendly and engaging process

Short questions, accessible language and young Design.

Creating a personalized process based on the user’s needs

Guiding the user according to their goals: Preparing for Retirement or Setting a Specific Savings Target.

Getting a foot in the door, then building commitment

Bringing the user into the system in the shortest process possible.

User freedom of choice

Giving the user a sense that they are choosing to share information with us, rather than feeling interrogated.

Concept - Guiding Principles:

Principal Journey

Screens

hope you enjoyed

Thank you for your time.

Let’s connect, and get to know each other

054-7431002